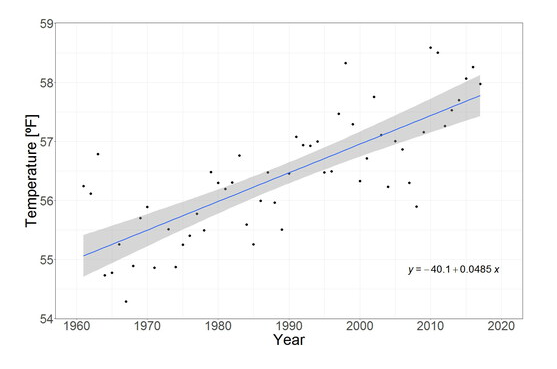

Weather derivatives are financial instruments that can be used by organizations or individuals to hedge risks associated with adverse weather conditions. Weather conditions can directly decrease profits by affecting the volume of sales or costs. This paper develops a methodology for temperature option pricing in equatorial regions. In this approach, temperature is forecast by combining deterministic and stochastic models. We find that forecasting daily temperature with a model that combines a truncated third-order Fourier series with a mean reversion stochastic process proves the most accurate for pricing the options. The methodology is calibrated with data gathered in Bogotá, Colombia, using Monte Carlo simulations.

https://www.tandfonline.com/doi/pdf/10.1080/0013791X.2021.2000086